The Real Estate Market vs The Inflation

“The energy index rose 28.5 percent over the past 12 months. The gasoline index rose 56.2 percent since May 2020, when it was at its lowest level since February 2016. The May 2021 increase was the largest 12-month increase since the period ending April 1980. The index for electricity increased 4.2 percentover the last year, while the index for natural gas rose 13.5 percent.”

According to U.S. Bureau of Labor Statistics (a) , the Consumer Price Index for All Urban Consumers has increased 0.8% in April and another 0.6% in May. The fastest increase was the index for used cars and trucks, 7.3% in May, food and energy 0.7% after a 0.9% increase in April.

Overall, all items index rose 5.0% for the last 12 months, trending upwards since January. This is the largest increase of the all items index except food and energy since the 12 month period ending June 1992. Food and energy price increases are even higher, seeing a larger increase since the period ending in 1980.

In this report you can see that the most significant increase is the price of fuels and all energy services over the 12 months period ending May 2021.

With the prices of unleaded gasoline 58.2% (b) higher today vs. 12 months ago, the risk of in inflation now is 4 times higher than it was last year. The increase in fuel prices are going to lead to a decrease in the purchasing power across the board.

In the real estate market we have seen a sharp increase in prices since the beginning of the year, a combined effect of low inventory and higher prices in construction supplies, relocations across states borders as well as a large increase of institutional buyers overbidding on existing properties. With an increase in prices, we may see less sales transactions and more rental transactions in near future.

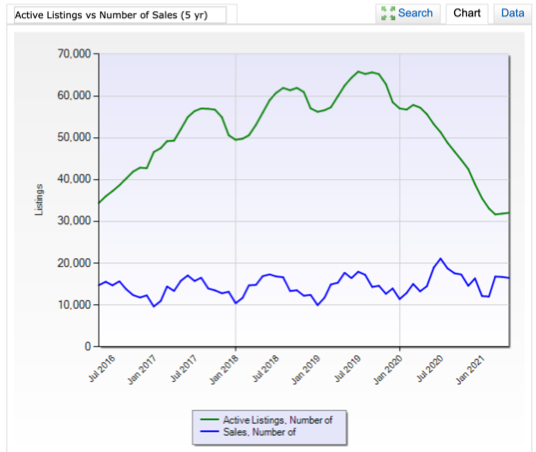

Statistically, the highest number of sales are taking place in July, which means the contracts are won in the period May-June. Active listings are also at their highest during May-June. This year is no exception, while noting that the total volume of the actual active listing are far under the numbers from before the pandemic. Fig. 1.(source NTREIS database)

For anyone who is looking to relocate or just to buy a house, this might just be the perfect time. Before you rush in, please consider the following:

1. If you don’t have enough for a cash offer, please get pre-approved first and start looking after. In this fast moving market the chance of having an offer accepted without a pre-approval is close to 0% (zero%.)

2. You may win by submitting an offer at the asking price but your chances are pretty low.

3. Asking for seller’s closing costs, survey, home warranty, also close to 0% (zero%). It may happen, but don’t count on it. So, be prepared for extra expenses. Have at least 2.5%-3.5% set aside for these expenses.

4. If you can offer a lease-back option to your seller, you might just have a better “hand” than the other buyers.

5. Try to clear your contingencies.

6. Consider your out of pocket expenses:

– Option Money – set aside $500-$1,000 (we are looking at 3 days max).

– Earnest Money – at least 1% from the purchase price

– Home inspection and Appraisal – price varies depending on the market – at least another $800-$1,500.

7. Be prepared with extra cash to cover the appraisal gap. The expectations that a house will appraise at the list price are lower. Not only you will have to cover the difference from the list price to offer price, you might be in the situation where a house appraises under the list price, and your lender will only cover a certain percentage of the appraised value.

8. If you agree to sign a contract before you’ve seen the house, your chances of winning the contract are significantly lower than if you had visited the house. Sellers don’t want to take the risk that you may not like it and cancel the contract while in the option period.

9. Before you submit your offer, take a good look at the house. Most of the time there are minors repairs needed. Be prepared for it and don’t back out because of those. Not only is a waste of time, there is a good chance you may not get your earnest money back.

10. Once you have been pre-approved and under contract, do not make any larger purchases or open new credit accounts. That might disqualify you from getting the loan and close on your new home.

11. If you are serious about your purchase, don’t go alone. Find an agent that you can trust and let your agent help you navigate the process. By the way, the one thing that sellers are still paying for these days, is your agent’s commission.

There’s never been a more important time to have resources you can count on when it comes to buying and selling a home. The real estate market and industry change at a rapid rate. It is my pleasure to make sure that you always have the current information you need to make the best decisions for you and your family.

If you ever have a real estate question or need, or know someone who does, call today. I’m here to help! 214-826-0752.