Buying Your Next Home

Buyer-seller Menu

Believe it or not, now is a great time to buy a real estate property. Either is your next home, a piece of land or investment property, now is the right time. Because if it wasn’t, you wouldn’t be here looking at Texas properties. You would probably use your time to do something completely different.

I appreciate you being here, and if you don’t know where to start, start here, and get it right from the beginning. In this way, you save time and avoid mistakes.

3 Stepping Stones In The Home Buying Process

Get The Right Support Team

Get The Right Game Plan

First, you need to Get

The Right Information

In today’s world, information is coming to you from all directions, but how do you know how to disseminate? How do you know the information you receive is trustworthy and current? How long it will take you to do all that in order to make the right decision regarding one of the most expensive purchases of your life?

If your job is an aerospace professional, for example, and need to have a health evaluation, you would probably choose a medical professional. A medical professional not only has access to the information you need, but also has the expertise to make the right diagnosis. If you were to diagnose yourself you would spend more time and money learning how to do it and get access to all the tools and resources the medical professional has. The same is true in any profession, including real estate. Real estate brokers and agents like me, have the training, resources and most importantly the expertise of real estate transactions. We also are a trusted resource for home buyers and sellers as well. In fact, getting in touch with a real estate agent and request pertinent market information is a service that we gladly provide for interested buyers and sellers. Developing a relationship with a real estate professional helps you in the long run too.

.

Second, you need to have

The Right Support Team

Once you make a decision that is time to find a new property, you will want to work with people you trust, right? By now, you should have built a relationship with a real estate professional, and I’d love that to be me. But this is not the only professional working for you. The agent’s broker will be in your team too, and most often, they already have a network of trusted professionals. We are talking about lenders, home inspectors, credit repair, title, contractors and other professionals that are already vetted and you won’t have to spend time scrambling to find people in your team, right? That’s how you save time and money too.

.

Third, you must have

The Right Game Plan

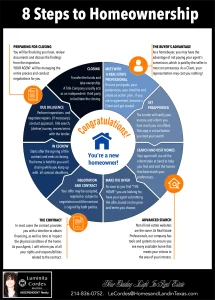

You success can only be as good as you plan. The last thing you ever want is to find the ideal home you always dreamed of and not be ready to buy. There is no bigger disappointment than knowing that if you just did this or that you would not have missed it! Success doesn’t just happen, success is the result of careful planning, coordination and execution. I’ve seen too many times buyers wasting their time and money by looking aimlessly in the wrong direction, and realize after months have passed by that they started without a sound plan, lost a lot of time and learned the hard way how not to do it.That’s why, I made this simple chart with the 8 essential steps in home buying process, that if followed will have the greatest chance of achieving success.

8 Steps to Homeownership

Step 1

Meet with a real estate professional

Step 5

Negotiation and Contract

Step 1

Meet with a real estate professional

Discuss your goals, your preferences, your timeline and create an action plan. If you are in agreement, become a Client and get started. I want to make a little mention here. Most of homebuyers have the belief that they have to be ready to buy when they are meeting with an agent. Nothing can be further from the truth. As I explained earlier, developing a relationship with an agent will give you the opportunity to know each other and gather information. You may need to start with a list of agents and narrow down the one you trust the most and offers you the best resources. I invite you to get in contact with us today and see if we are a good fit to work with us on your future real estate transactions.

Book now your free “Strategy Call” so we can start by knowing each other.

Note: The Buyer’s Advantage: As a homebuyer, you may have the advantage of not paying your agent’s commission, which is paid by the seller is most circumstances. As a Client, your representation may cost you nothing!

Step 2

Get Pre-approved

The Lender will verify your income and inform you how much you can afford. This step is critical before you start your search.

This is the second step in your home purchase journey because of this simple question: “When you find the right property, how are you going to pay for it?” Did your rich aunt left you a truck-load of cash? Did you close on a settlement and you ended up with a truck-load of cash? Or just got a truck-load of cash from somewhere and that’s how you are going to finance your purchase? If that’s the case, please send me a quick message and I will call you right now so you can get moved to your new residence right away, before the inflation starts chipping into the real value of your cash.

If you have no such thing as a truck-load of cash, and you are like most of us, you probably should finance your next real estate purchase by securing a loan.

Who can give you a loan? Well, that’s a great question. If you have a business relationship with hard money lenders, then you already know what you’re doing, so you can just skip to the next page. If not, you may need to use a bank or a mortgage broker in order to obtain the money you need for this type of purchase. And we can help you with that.

If know how much of a house (or any type of real estate property) you can afford, but you need help in understanding the process, I hope you will find our Buyer’s Guide quite helpful. Request a copy of our guide right now here.

For everyone else, I would like to share a bit of information with you. There is no rule on how long it takes for someone to get a loan pre-approval. Banks, mortgage brokers and lenders in general have a specific criteria in evaluating a consumer’s ability to pay back a loan and based on that, they calculate the amount of loan they are willing to offer. In order to qualify for a loan, you need to fill out an application. During the application process, you are asked about your income, expenses, credit history, other debt, employment status and pretty much all your financial life since you can remember. It sounds complicated and difficult, but if that would be the case nobody will ever get a loan, right? In reality, the process is straight-forward and pre-approvals can actually be obtained in one day. When your information goes through a verification process, the lenders will pre-qualify you and will give you a letter stating how much are they willing to give you. At this point, they will also inform you which type of loan fits you best. If you are a first time home buyer, you may qualify for additional types of programs that will increase your financial being power.

Don’t miss the opportunity of buying a home because they you don’t believe you can qualify for a loan. If some improvements are needed, by checking with a loan officer on your financial power, you will find out which areas of your finances need improvement – or not.

I will say this again: the last thing you want, is to find the house you always dreamed of but loose it because you didn’t have all your ducks is a row. That’s why, making arrangements for financing ahead of time it is extremely important.

By knowing how much you can afford you can decide how much you actually want to spend on your home purchase. Now you know where and what to look for.

Let me give you an example:

If you get pre-approved for a $350,000 mortgage and you can also ad another $50,000 as down payment, you can look at homes within the $400,000 range. Find the characteristics of homes in the geographical area of your interest and now you know what to look for. You may need to make adjustments if necessary – change the geographical area for more home features, or adjust your home preferences to stay in a certain area, in other words, build your plan for your ideal home that also fits your finances.

Having your pre-approval letter from the lender gives you peace of mind that you can buy the home you fall in love with, and I promise you, I will only show you homes you can afford so you don’t fall in love with the wrong house. Being pre-approved makes your offer strong too. The seller will see you as a serious, prepared buyer who’s financing is the last thing for worries.

The conditions in the market are changing rapidly. In a seller’s market you may have to use more cash than you might use in a buyer’s market. In a buyer’s market, you have the chance to get the seller participate more to your closing costs, for example. If you’d like to hear more about the buyer’s and seller’s market, give me a quick email and I’m happy to call you back and chat about it.

To know if you may qualify for a loan fill out our form here and we will get you in touch with one of our trusted mortgage lenders. This is not an application for a loan, just a preliminary form. We only work with lenders we trust, however, when the time comes to apply for the loan, you are of course free to choose any lender you wish.

If you did not book your free “Strategy Call” do it now. We would be happy to connect and answer all your questions.

No purchase necessary. We can’t sell you anything at this point even if we want to. Seriously.

[/vc_column_text][vc_empty_space height=”25″][/vc_column_inner][/vc_row_inner][vc_row_inner row_type=”row” type=”full_width” text_align=”left” css_animation=”” css=”.vc_custom_1668911321241{margin-right: -25px !important;margin-left: -12px !important;border-right-width: 0px !important;border-left-width: 0px !important;padding-right: 0px !important;padding-left: 0px !important;}”][vc_column_inner width=”1/4″ css=”.vc_custom_1668913424822{margin-top: 0px !important;margin-right: 5px !important;margin-bottom: 5px !important;margin-left: 0px !important;padding-right: 3px !important;padding-left: 3px !important;}”][vc_column_text css=”.vc_custom_1669411145497{padding-top: 5px !important;padding-right: 5px !important;padding-bottom: 10px !important;}” el_id=”step3″]

Step 3

Search and visit homes

Your agent (me) will use all the information at hand to help you find and visit the homes that best match your preferences. This step will take as long as it needs until you find the ideal home. We will set a strategy to visit homes that best fit your preferences in order to avoid wasting your time and also patience with visiting properties just because they are for sale. To find the properties that best match our clients preferences, we employ vast resources, from a comprehensive real estate website and MLS access, to market analysis tools and professionals in multiple areas. We are collaborating and exchange information with lenders, title companies, contractors etc.

Note: Advanced Search. Not all real estate websites are the same. As Real Estate Professionals, our company has tools and systems to ensure you see every available home that meets your criteria in the area of our interest.

Step 4

Make the offer

As soon as you find “The Home” you are looking for, have your agent submitting the offer, based on the price and terms you choose. By now, you know exactly what you want so your decision may come easier than you expect. However, it is important to careful consider your agent advice, balance the pro’s and con’s before you make the decision to submit your offer.

At this time, your loan officer will send you the pre-approval letter based on the price you offer and the loan type. During the escrow period, all your credentials will be verified by the lender which will give you the final approval for your loan. It is important to offer your lender

Step 5

Negotiation and Contract

Your offer may be accepted, rejected or subject to negotiation until the contract is signed by both parties.

There are situations where your offer may not be accepted. If you are not successful the first time, don’t give up. It just means it wasn’t for you. Move on quickly and you will find what you’re looking for in no time.

Note: The Contract: In most cases the contract provides you with a timeline to obtain financing, as well as time to inspect the physical condition of the home. As your agent, I will inform you of all your rights and responsibilities related to the contract.

Step 6

In Escrow

Starts after the signing of the contract and ends at closing. The home is held for you until closing while you keep up with all contract deadlines.

In fact, step 6 includes step 7 and 8 too.

Step 7

Due Diligence

Perform inspections and negotiate repairs (if necessary), conduct appraisal, title search, (deliver) survey, review terms with the lender.

Performing inspections is not required in most cases. However, this is the time when you as a buyer will want to conduct inspections to find out if there are any repairs necessary that were not disclosed previously. Anything discovered during those inspections could lead to new negotiations and sometimes even to cancellation of the contract. It is important to perform those during the option period. In this way, you can review and discuss those findings with your agent, which in turn can conduct more negotiations n your behalf without the risk of you loosing the earnest money deposit.

Once the contract comes out of the option period, you and your team will work towards preparing for closing. You will be finalizing your loan, review documents. Your agent will be managing the entire process coordinating with the lender and title company to meet the deadlines for closing.

Step 8

Closing

Transfer the funds and take ownership. We talked about the Title Company which usually acts as an independent third party to facilitate the closing. At closing table, don’t forget to bring your ID and practice your smile so you can take a great picture!

Congratulations! You’re a new homeowner!

Schedule Your Personal Strategy Call

We thought you might like:

Do You Qualify for a Loan

Many people are missing to buying a home because they don’t have the right information. When asked “Do you qualify for a loan”, they answer “I don’t know”, because they never tried to find out. If you are looking for a trusted professional, and don’t know where to start,

Open Houses

Do you have some free time in the week-end? You can get a lot done by visiting the Open Houses in the area you want to move in. Call you agent ask ask for detailed informations not those homes and the neighborhoods they are in. Have fun!

Buyer’s Guide

Finding and buying the ideal property can be a dream come true. There is something special about walking up to the front door on moving day, sliding in your key and entering the foyer of your beautiful new home. That’s why I made this Buyer’s Guide for everyone considering purchasing a home.